SME in emerging markets will become more analogous with those in developed markets during the next 5 years; they will rely much more on Internet connectivity, and will demand better and more-affordable options for both fixed and mobile broadband.

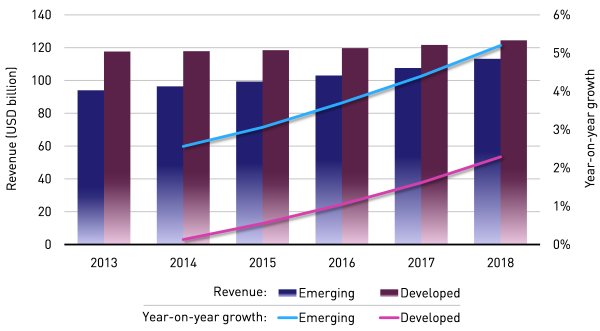

Analysys Mason’s recently published report ICT services for SMEs worldwide: forecasts and analysis 2013–2018 provides a 5-year forecast of ARPU, connections and revenue for ICT services for small and medium-sized enterprises. Our forecast shows that emerging markets will account for 47.6% of worldwide revenue in 2018, an increase from 44.4% in 2013. Total revenue will increase in both emerging and developed markets, but the CAGR increase in emerging markets (3.8%) will be greater than in developed regions (1.1%).

Figure 1: SME ICT services revenue, developed and emerging markets, and year-on-year revenue growth, 2013–2018 [Source: Analysys Mason, 2013]

Mobile voice and data and fixed broadband will drive revenue growth in emerging markets

Total revenue in emerging markets will increase from USD94.01 billion in 2013 to USD113.19 billion in 2018, at a CAGR of 3.8%. Mobile voice and data will continue to be extremely important to SMEs in emerging markets, because coverage is far wider than fixed networks, and the cost is more competitive against fixed alternatives than in developed markets. Adoption of fixed-line services, both voice and broadband, will also contribute significantly to this growth, as operators roll out improved infrastructure and increase coverage, and as the cost of these services decreases.

Cloud services will also contribute to revenue growth in emerging markets: revenue in this sector will increase from USD0.37 billion in 2013 to USD2.09 billion in 2018 at a CAGR of 41.3%. This jump in revenue will be driven by increased adoption of cloud services because of improvements in availability and reliability of broadband connectivity, and as SMEs in emerging markets become increasingly reliant on IT and data. The CAGR of revenue for cloud services is particularly high because adoption levels are currently very low.

Barriers to cloud services adoption differ between developed and emerging markets. In developed markets SMEs are more likely to have existing, on-premises services, and are reluctant to replace these. In emerging markets, the key barriers to cloud adoption are low PC adoption and a lack of awareness of the cloud-based solutions available. We expect higher CAGR increases in emerging markets than developed because current levels of adoption are lower than in developed markets, and as fixed and mobile broadband services become more ubiquitous, and PC, smartphone and tablet adoption increases.

Flexible working practices are contributing to increased cloud services revenue in developed markets

In developed markets, SME ICT services revenue will grow more slowly than in emerging markets, at a CAGR of 1.1% from USD117.67 billion in 2013 to USD124.44 billion in 2018. In these more mature markets, fixed voice and broadband services have reached saturation point, and additional lines are more often replacements, for example Ethernet lines replacing leased lines or xDSL lines. The competition in these markets also ensures downward pressure on ARPU.

Mobile handset data and mobile broadband (via USB modem) are key growth areas as enterprises become increasingly mobile with smartphone and tablet roll-outs, and employees are enabled to work remotely and remain connected.

Cloud services revenue is increasing fast in developed markets as well as emerging markets. Adoption is picking up as enterprises seek to reduce spending on IT infrastructure and support, and because of improved mobile broadband, more mobile devices in the workplace as a result of bring-your-own-device (BYOD), and enterprises and employees adopting flexible working practices. Cloud services revenue for SMEs in developed markets will increase from USD3.06 billion to USD7.71 billion between 2013 and 2018.

SMEs in emerging markets will become more analogous with those in developed regions during the next 5 years. They will rely much more on Internet connectivity, and will demand better and more-affordable options for both fixed and mobile broadband. Better connectivity will increase the demand for cloud services, to further enrich the technology environment.